In 1971, six emirates, Abu Dhabi, Ajman, Dubai, Fujaraih, Sharjah, and Umm Al Quwain formed the United Arab Emirates (UAE). One year later, another emirate, Ras al Khaimah, joined.

An Emir rules each emirate, and they are all part of the Federal Supreme Council, which elects the President and Vice President of the UAE. Since 1971, the country has had three presidents, all of whom were rulers of Abu Dhabi (capital city) when elected. Abu Dhabi is a synonym for oil and political power, while Dubai means diversification and globalization, but we will talk about this in the following post.

I cannot stop thinking, when I look through the window all the modern and futuristic buildings that makeup Dubai’s landscape, that in 1980 this place was just a village with less population than Bahia Blanca (300k), the city where I was born. Today it has more than 4 million people.

To understand how this city abruptly changed in the last forty years, we must understand the context and first steps that were taken in the early 20th century. When doing that, it is impossible for me not to think about the Laffer Curve.

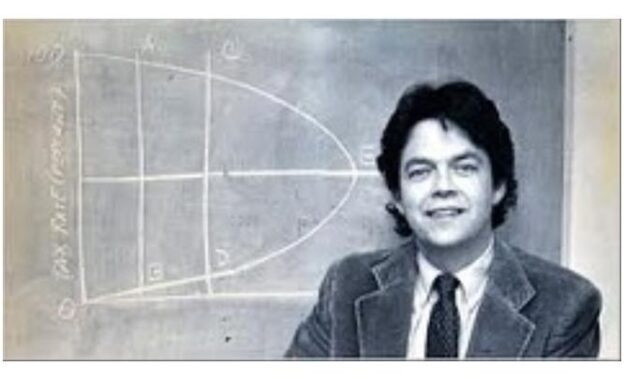

The Laffer curve states that the relationship between the magnitude of a tax (let’s say income tax) and the income that the government can collect is like an upside-down face: if you tax 0%, you will be able to gather not more than $0, but if you tax 100% you will also collect $0. In the middle, something very particular can happen.

A general and simplified idea of Laffer’s curve is that, after some threshold, tax is so high that an individual’s incentives to generate income are very low. Consequently, increasing taxes could backfire, and perhaps the tax collection could be higher if taxes were lower. Much literature has focused on testing this theoretical prediction and estimating what percentage represents the famous threshold. What I understood in these weeks is that how Dubai was born is highly related to this concept.

I came to the UAE with two friends and classmates: Harumi and Mundaca. Harumi studied the path of economic diversification that the UAE has transited, so she explored some of the History of this region and shared with me a particular event that has a lot to do with the rise and growth of Dubai.

In the nineteenth century, the city of Lingah in Persia (now Iran) was one of the most important ports in the region. It was the meeting point between two worlds, East and West. However, the Persian government had a terrible idea. Close to the 1900s, they were looking for new revenue sources, and the decision was to impose new taxes. Some years later, taxes were raised, and that was the straw that broke the camel’s back, making traders search for new ports.

Even though the villages of Sharjah and Ras Al Khaimah offered better features in terms of location and population, the ruler of Dubai understood that the city could be selected if doing the opposite of the Persian government. As Hvidt (2007) points out, the government declared Dubai a free port and, in 1903, established every import and export tax at 0%. At the same time, he offered traders other amenities, such as protection and land benefits. Lastly, the ruler declared that every business person or trader must be tolerant and that no ethnic or religious issues would affect the security and opportunities of the village.

As a result, the main goal of getting more income through taxes was self-defeating for the Persian government: the tax was higher, but people left. On the contrary, Dubai did not want to collect revenues directly from taxes, but it is indubitable that they benefited from this inflow. The city started to have an infrastructure and mindset toward trade and business that was crucial for the incoming years at the end of the 20th century.

In the 1970s, Dubai received a new flow of traders since Iran raised taxes in Lingah. Yes, again. The same port, the same story. In addition, India also established taxes on activities related to the gold trade, contributing to a further reallocation of business.

Laffer curve is easily understood in this context. When looking for more income, be aware that you can generate the opposite effect. In this case, it was extreme since traders not only stopped doing their activities in the intensive margin, but they also took radical decisions and moved to another land with clear and more friendly rules.

References

Hvidt, M. (2007). Public-private ties and their contribution to development: The case of Dubai. Middle Eastern Studies, 43(4), 557-577.